Loans Up to ₹2,50,000 For Everyday Business Needs

Collateral-free merchant loans with clear terms and predictable repayments.

Loan Eligibility Criteria

Just a few things you need, nothing more.

Age Requirement

Available for business owners between 21 to 55 years of age.

Verified merchant profile

You should be a verified merchant with an ongoing business.

Active QR with regular collections

An active QR with daily customer payments helps us assess cash flow.

Loan For Your Business In 4 Days

Loan For Your Business In

Check eligibility

Share a few basic business details to see if a loan fits your business.

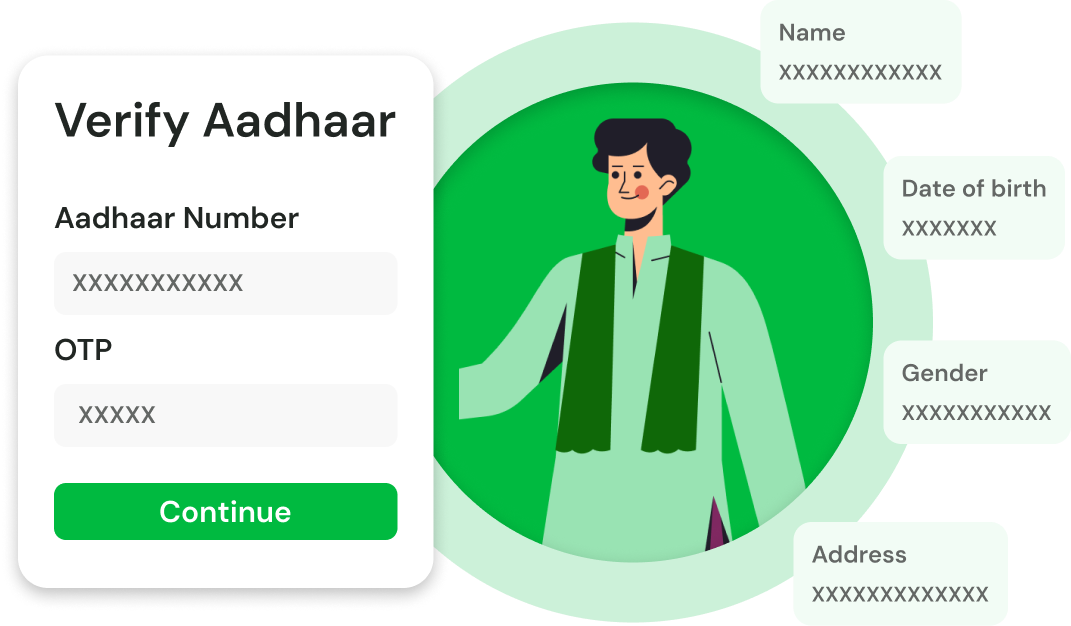

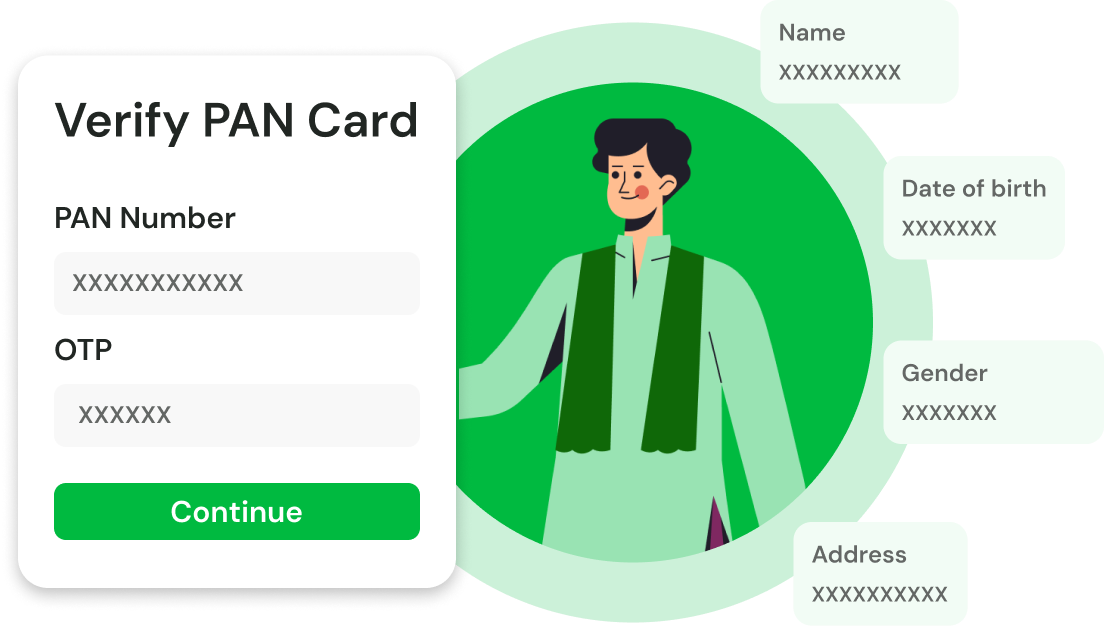

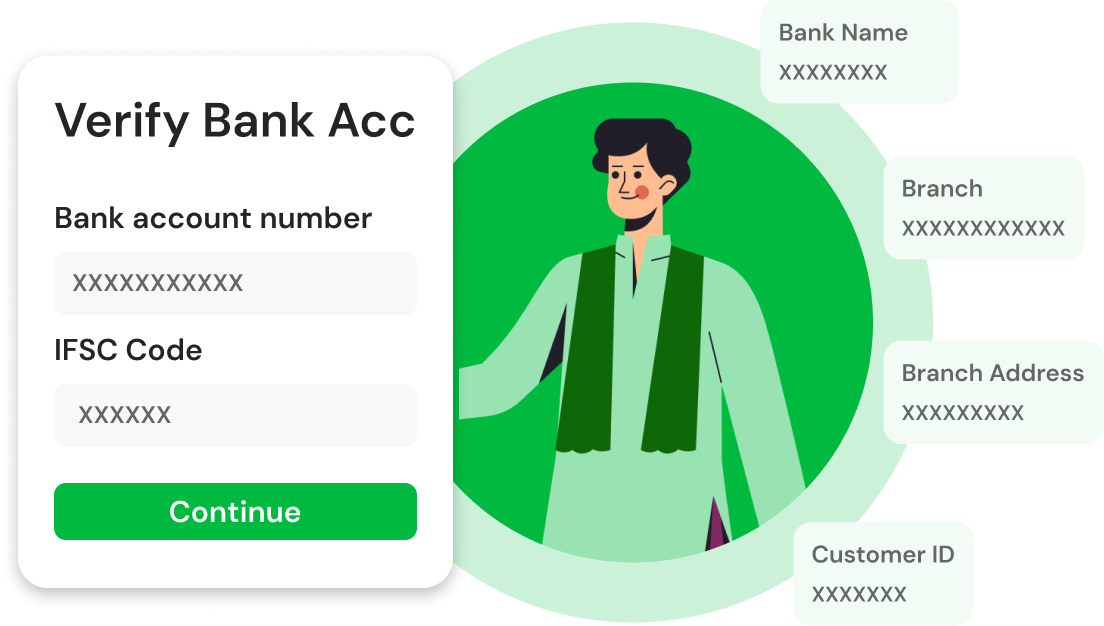

Complete verification

Finish Aadhaar, PAN, and bank verification digitally and securely.

Review loan details

See your loan amount, charges, and repayment schedule clearly before you proceed.

Get funds & repay smoothly

Funds are credited to your bank account. Repayments follow the planned schedule.

Loans Designed To Work The Way Your Business Works

Daily repayments

No collateral

Get more with time

Transparent charges

Minimal Documents, Clear Process

Aadhaar for verification

Used to verify your identity and complete digital authentication securely.

PAN for KYC

Bank account details

FAQs

What is InstaVyapaar?

Who can apply for an InstaVyapaar loan?

Business owners between 21 to 55 years of age with an active business, a verified merchant profile, and regular QR-based collections can apply.

Is collateral required to take a loan?

How are repayments structured?

Repayments are planned daily to stay predictable and manageable, aligned to your business cash flow. Your repayment schedule is clearly shared before you proceed.

What can I use the loan for?

What documents are required to apply?

Only basic documents are required: Aadhaar, PAN, and active bank account details. All verification is done digitally.